7 min read

Update on the First-Year Depreciation Tax Rules for Businesses

The One Big Beautiful Bill Act (OBBBA) included favorable changes to the federal income tax rules for depreciating...

Submitted By: Samuel D. Fries on Apr 13, 2023 2:00:00 PM

The stock markets have experienced significant volatility over the last year, causing many investors to realize some significant gains—and incur some significant losses. This extreme volatility is expected to continue through the end of 2023.

How will stock trades affect your federal income taxes? Here's what investors should know about reporting gains and losses from buying and selling stock. Similar principles generally apply to gains and losses from mutual funds, cryptocurrency and fixed income assets.

Investments in Tax-Favored Retirement Accounts

Wild swings in the value of investments held in tax-favored retirement accounts—such as a 401(k), traditional or Roth IRA, or self-employed SEP account—have no current tax impact. It doesn't matter if the swings are from executed trades or from fluctuations in the value of investments that you still hold.

Changes in the market value of securities affect the value of your account, but they have no tax impact until you start taking withdrawals. At that point, a higher account value will result in more taxes as you liquidate the account. Conversely, a lower account value will result in lower taxes. If you have a Roth IRA, qualified withdrawals taken after age 59½ will be federal-income-tax-free regardless of how much the account is worth.

Investments in Taxable Brokerage Firm Accounts

If you invest in marketable securities with a brokerage firm, unrealized gains and losses (paper losses) don't affect your tax bill. However, cumulative gains and losses from executed trades of these securities do have federal income tax implications.

If your taxable accounts incur more losses than gains for the year, you'll have a net capital loss for the year. Follow these four steps to determine the tax results in this situation:

Any remaining net short-term or long-term capital loss is carried forward to next year, where it can be used to offset capital gains in that year and beyond.

On the flip side, if your taxable accounts incur more gains than losses for the year, you'll have a net capital gain for the year. Follow these three steps to determine the tax results in this situation:

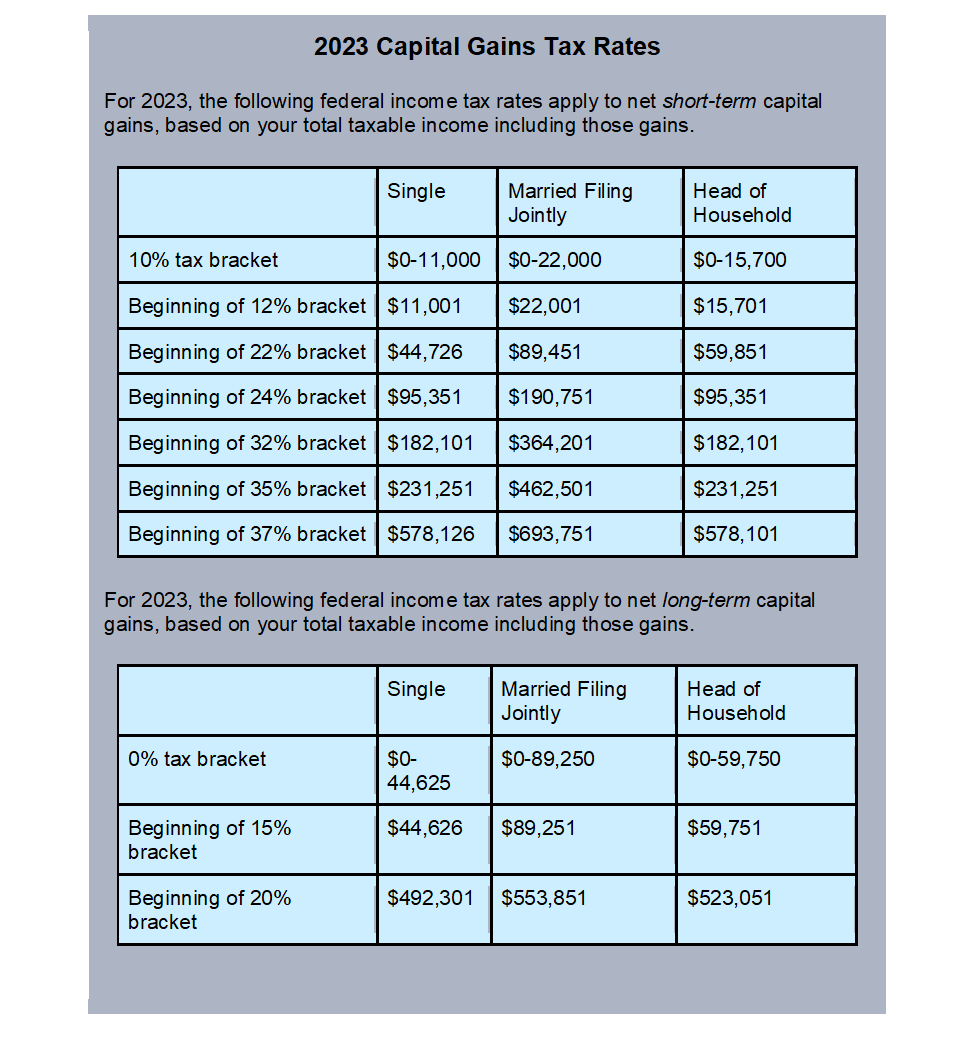

If you have a net short-term capital gain, it will be taxed at your regular federal income tax rate, which can be as high as 37%. (See "2023 Capital Gains Tax Rates," at the end of this article.) You also might owe state income tax and the 3.8% net investment income tax (NIIT) on a net short-term capital gain. (See "Will You Owe NIIT?" below.)

If you have a net long-term capital gain (LTCG), it will be taxed at the lower federal capital gain tax rate, which can be 0%, 15% or 20%. Most individuals will pay 15%. High-income individuals will owe the maximum 20% rate on the lesser of: 1) their net LTCG for the year, or 2) the excess of their taxable income for the year, including any net LTCG, over the applicable threshold. For 2023, the thresholds are:

You also might owe state income tax and the 3.8% NIIT on a net LTCG.

Will You Owe NIIT?

Higher-income individuals with net capital gains are potentially exposed to the 3.8% net investment income tax (NIIT). The NIIT hits the lesser of:

The thresholds are as follows:

This means you could owe Uncle Sam up to 40.8% on a net short-term capital gain (37% plus 3.8%) and up to 23.8% on a long-term capital gain (20% plus 3.8%).

Beware of the Wash Sale Rule

Under the unfavorable wash sale rule, a tax loss from selling stock or mutual fund shares held in a taxable account is disallowed for federal income tax purposes if, within the 61-day period beginning 30 days before the date of the loss sale and ending 30 days after that date, you buy substantially identical securities.

The theory is that the loss sale and the offsetting purchase of substantially identical securities within the 61-day period amount to an economic "wash." Therefore, you're not entitled to any tax loss, and the tax savings that would ordinarily result from the loss are disallowed.

If you have a disallowed wash sale loss, the disallowed loss is added to the tax basis of the substantially identical securities that triggered the wash sale rule. When you eventually sell those substantially identical securities, the extra basis reduces your taxable gain or increases your taxable loss.

Wait and See

The tax results for trades executed in 2023 are up in the air until all the gains and losses from trades executed during the year are tallied up. Your tax pro may be able to suggest some tax planning moves to make between now and year end to optimize your tax results.

© 2023

7 min read

Feb 18, 2026

The One Big Beautiful Bill Act (OBBBA) included favorable changes to the federal income tax rules for depreciating...

5 min read

Feb 11, 2026

Do you know the current rules for claiming tax deductions for business meals and entertainment? Whether you're wining...